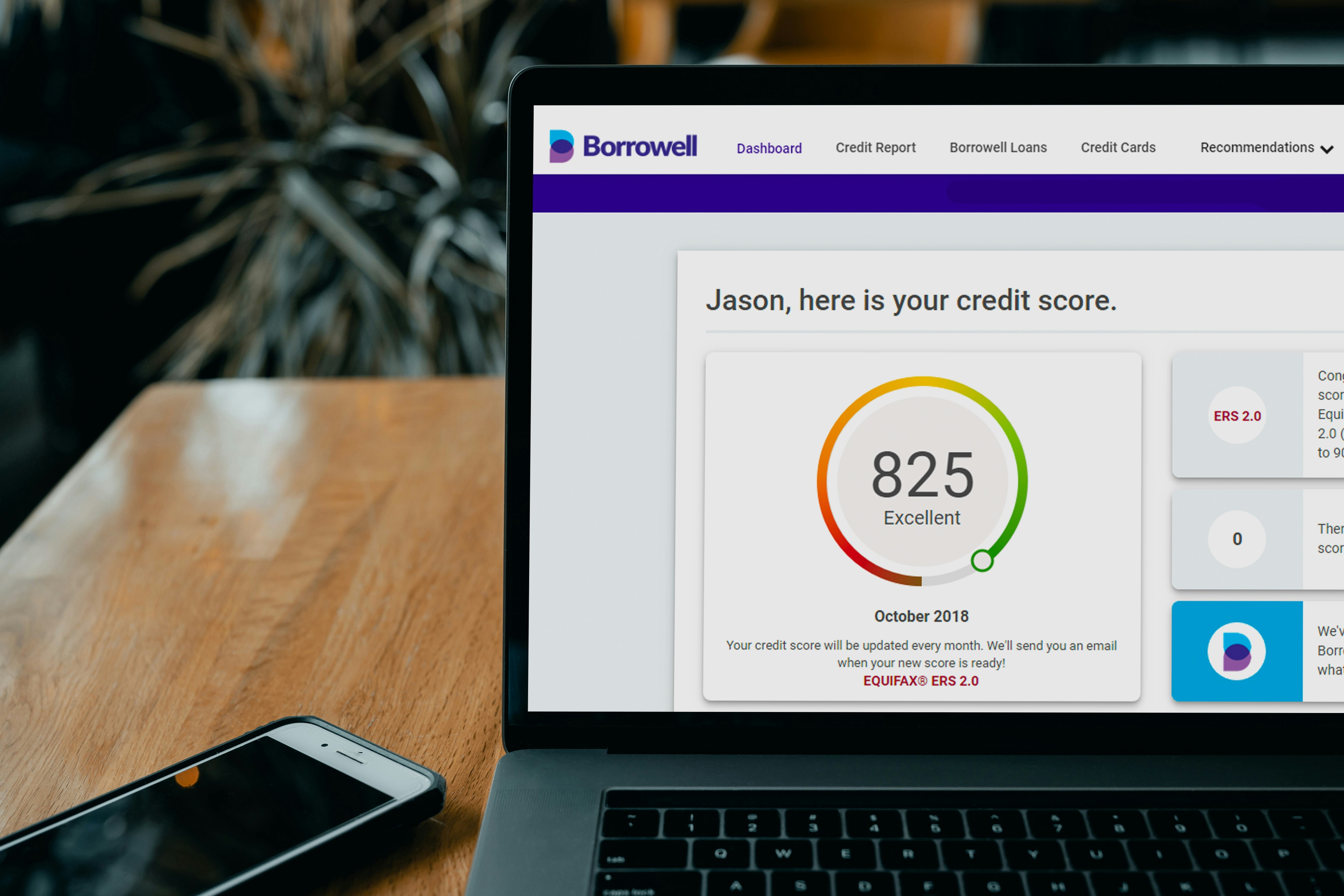

Understanding Your Credit Score

Your credit score plays a pivotal role in your financial health. A score above 700 is considered good, providing access to better loan terms and interest rates. However, achieving this level requires commitment and strategic planning. In this article, we outline five essential steps to help you push your credit score beyond 700.

1. Pay Bills Promptly

Timely bill payments are crucial for maintaining a healthy credit score. Late payments can significantly impact your score, leading to a reduction in your creditworthiness. Set reminders or automate payments to ensure you never miss a due date.

2. Maintain a Low Credit Utilization Ratio

Keeping your credit utilization ratio below 30 percent is a key strategy in boosting your credit score. This ratio measures how much of your available credit you’re using. For example, if you have a credit limit of $10,000, aim to keep your charges under $3,000. This demonstrates responsible borrowing and signals to lenders that you can manage credit effectively.

3. Maintain a Healthy Credit Mix

A diverse credit mix can positively influence your credit score. Consider having a combination of credit types, such as credit cards, installment loans, and retail accounts. This variety shows creditors that you can manage different types of credit responsibly.

4. Regularly Check Your Credit Report

Monitoring your credit report helps you understand where you stand and can alert you to any discrepancies or fraud. Obtain a free report annually and correct any errors that might be dragging your score down.

5. Avoid Opening New Accounts Frequently

Each time you apply for a new credit account, a hard inquiry is made, which can temporarily reduce your score. Limit new credit applications and only open accounts when necessary. By following these five steps, you’ll be well on your way to achieving a credit score beyond 700, allowing you to unlock better financial opportunities.

Discover more from Techtales

Subscribe to get the latest posts sent to your email.