Understanding the Downgrade

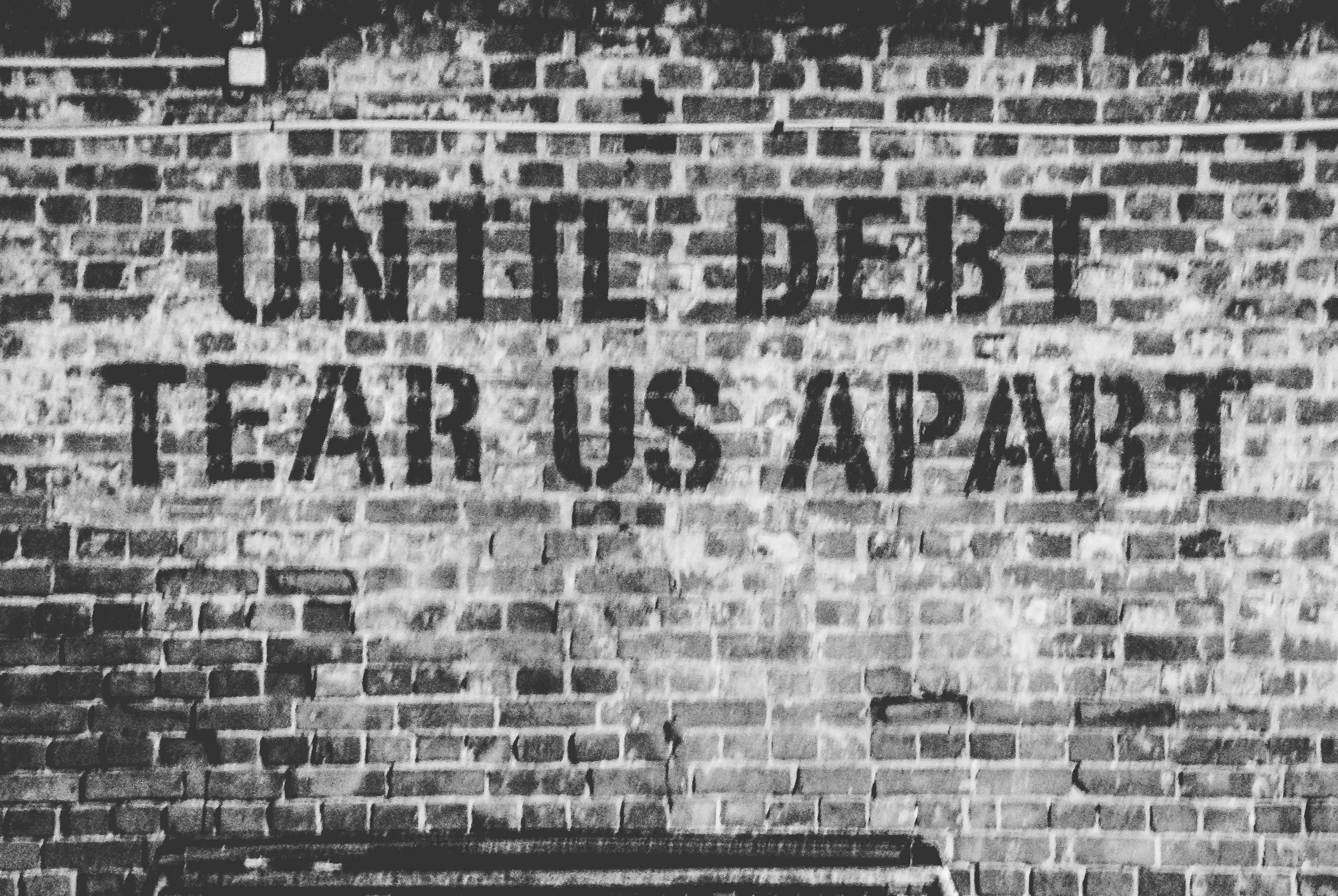

Recently, Moody’s Investors Service has downgraded the United States’ credit rating from AAA to AA1. This decision reflects persistent concerns about the nation’s increasing debt levels and rising interest payments. The move comes as a significant shift, following similar actions by Fitch Ratings, marking a critical moment in the U.S. economic landscape.

Causes of the Downgrade

The downgrade to AA1 signifies a growing concern regarding America’s financial stability. Over the past few years, the national debt has surged, leading to heightened attention from credit agencies. Moody’s assessment highlights that excessively high debt levels can limit economic growth and impact the government’s ability to meet its financial obligations. Rising interest payments contribute to this precarious situation, as they consume a larger portion of the federal budget.

What It Means for the Economy

The loss of the AAA credit rating could have far-reaching implications for the U.S. economy. Investors often view AAA-rated bonds as the safest financial instruments. A downgrade may lead to higher borrowing costs for both the government and consumers, as confidence in the country’s fiscal management diminishes. As interest rates potentially rise, individuals and businesses could face more expensive loans, which might slow down economic growth and investment.

In conclusion, America’s downgrade to AA1 is not just a reflection of numbers, but a pivotal indication of changing economic dynamics. Understanding the underlying factors is crucial for assessing future financial strategies and impacts on the economy.

Discover more from Techtales

Subscribe to get the latest posts sent to your email.