What is a Credit Score?

A credit score is a three-digit number ranging from 300 to 900 that reflects an individual’s financial health. In India, credit scores are crucial as they help lenders assess the creditworthiness of borrowers. Scores above 750 are considered good and increase the chances of loan approval at favorable terms.

Factors Affecting Your Credit Score

Several factors influence your credit score, including timely repayments, credit utilization, and the overall length of your credit history. Timely repayment of loans and credit card bills showcases a responsible approach to credit management, while keeping your credit utilization low — ideally under 30% of your total credit limit — demonstrates financial discipline.

How to Improve Your Credit Score

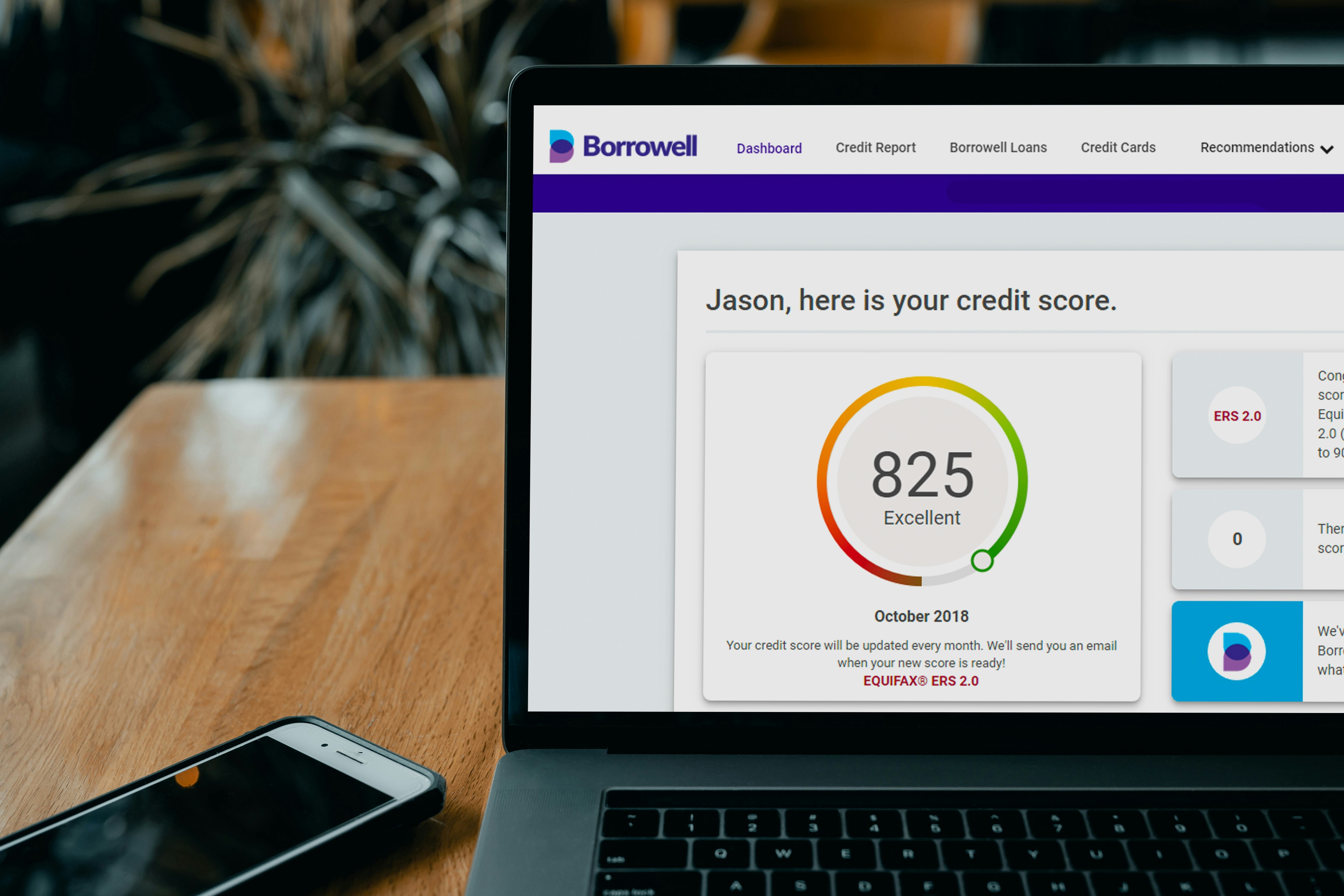

Improving your credit score can enhance your loan eligibility. Regularly monitoring your credit report allows you to identify any discrepancies that might affect your score. Additionally, making timely repayments and maintaining low credit utilization are effective strategies. If you have a low score, consider using secured credit cards or small loans to build up your credit history gradually.

Discover more from Techtales

Subscribe to get the latest posts sent to your email.