What is Personal Loan Settlement?

Personal loan settlement occurs when a borrower negotiates with a lender to pay less than the full amount owed on a loan. This often happens when an individual is experiencing financial hardship and cannot maintain regular payments. While this can offer immediate relief by lowering debt, it also brings potential consequences for your credit profile.

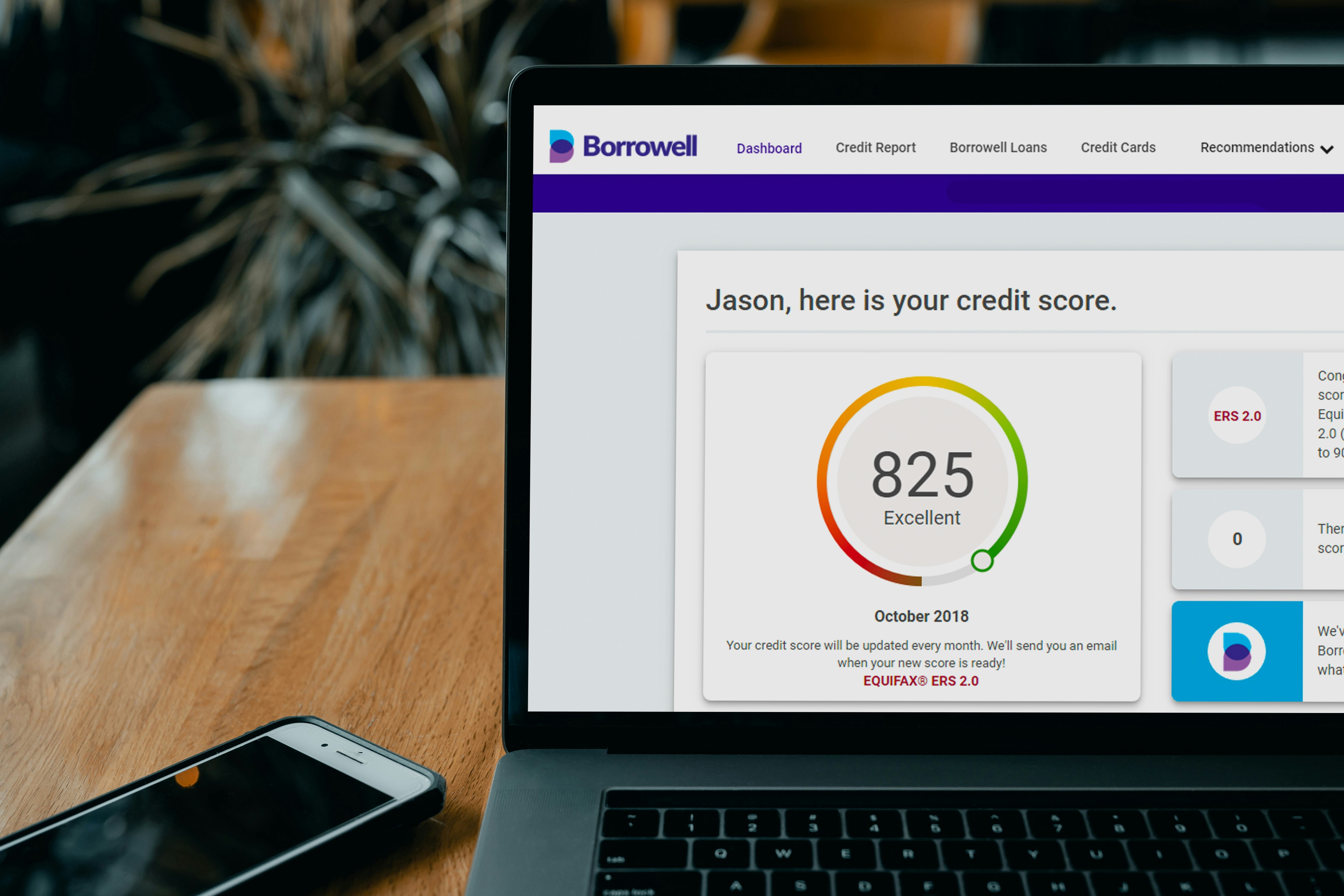

Effects on Your Credit Score

A personal loan settlement significantly impacts your credit score. When a loan is settled, it is usually marked as ‘settled’ on your credit report, which indicates that the debt was paid for less than the full amount. This can lead to a drop in your credit score, making it more challenging to obtain future loans or credit. The severity of the impact often depends on your credit history and how long the account has been overdue.

Long-term Impact on Your Credit Report

The settlement can remain on your credit report for up to seven years, influencing your creditworthiness during this period. Lenders may view settled loans as a risk factor, possibly leading them to decline future credit applications or offer loans with higher interest rates. However, it’s important to note that consistently managing other credit accounts well can mitigate these effects over time.

In conclusion, while personal loan settlement can provide immediate financial relief, it is essential to understand its potential consequences on your credit score and report. Careful consideration and planning are crucial to navigating this financial decision.

Discover more from Techtales

Subscribe to get the latest posts sent to your email.