Introduction

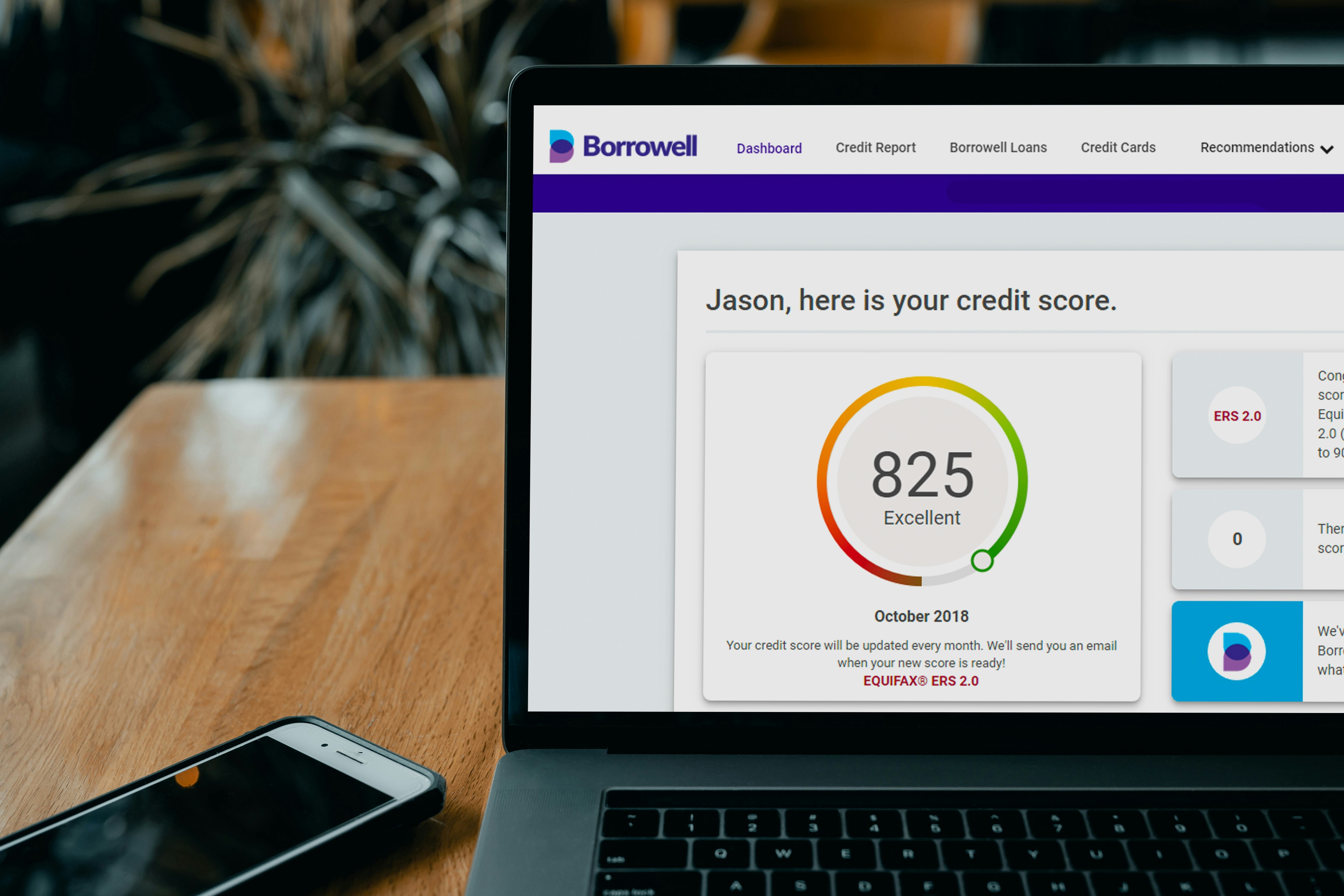

Applying for an ICICI credit card can be a straightforward process if you are well-prepared. One of the critical factors considered during the application is your credit score. This score plays a significant role in determining your eligibility for credit cards, including those offered by ICICI Bank.

Minimum Credit Score Requirements

To enhance your chances of approval, it’s essential to be aware of the minimum credit score you’ll need when applying for an ICICI credit card. Generally, a score of 750 or above is recommended. This benchmark is consistent across many banks and helps to assure lenders of your creditworthiness.

Improving Your Credit Score

If your current score does not meet the suggested minimum, consider taking steps to improve it before submitting your application. Paying down outstanding debts, ensuring timely bill payments, and avoiding new credit inquiries can all help to boost your score. These efforts not only increase your chances of getting the ICICI credit card but also provide better terms should you be approved.

In conclusion, understanding your credit score is essential when applying for any credit card. By aiming for a minimum score of 750, you can improve your likelihood of success with ICICI Bank’s credit card options. Keep your financial health in check, and you’ll have a smoother application process.

Discover more from Techtales

Subscribe to get the latest posts sent to your email.