Understanding Credit Scores

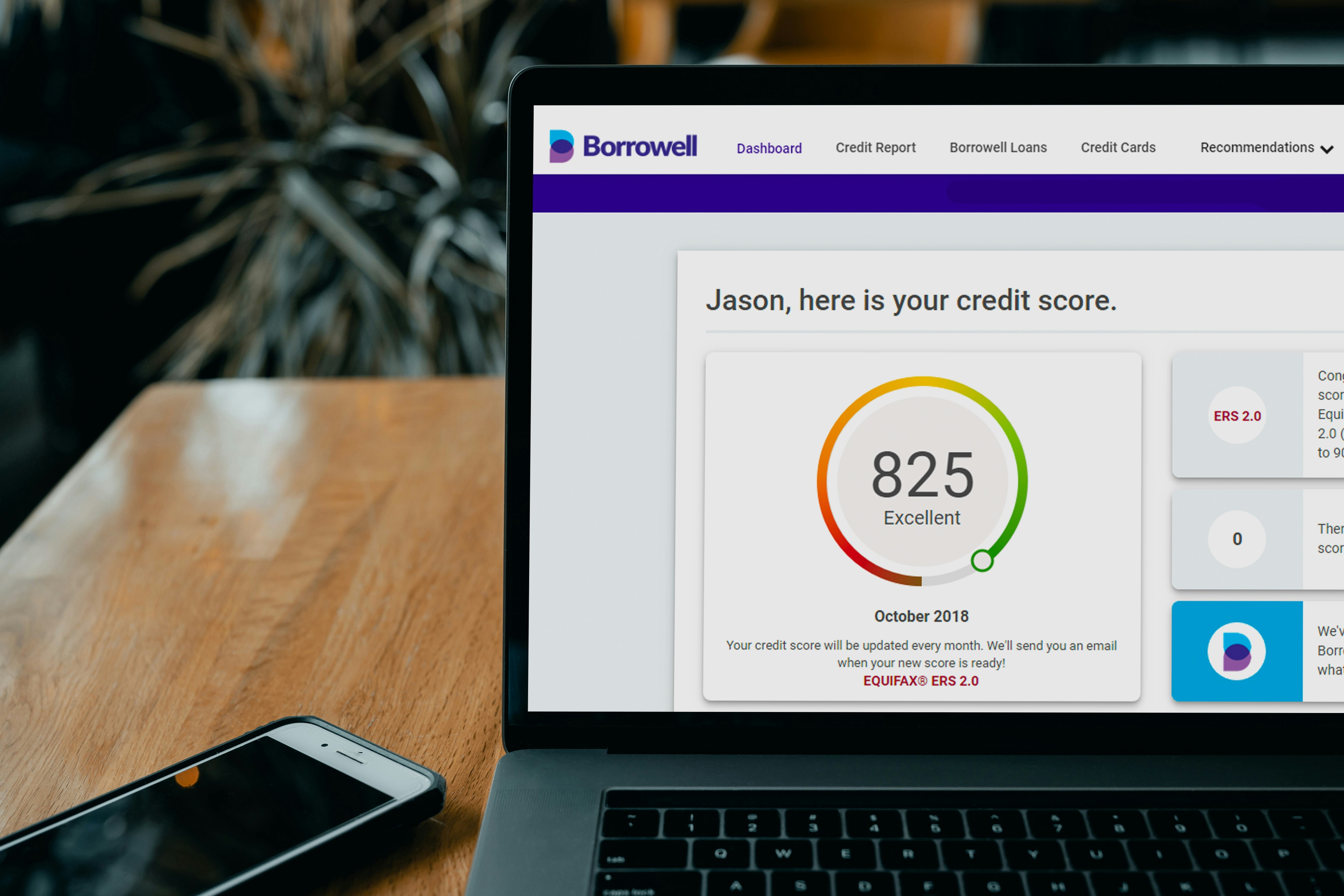

Your credit score is often considered the primary indicator of your creditworthiness. An 800 credit score is an impressive achievement, suggesting a solid repayment history and responsible credit use. However, not all lenders focus solely on this number when assessing loan applications.

Income Stability Matters

Even with an excellent credit score, unstable income can significantly impact your loan approval chances. Lenders prefer borrowers with a reliable income source to ensure that they can meet repayment obligations. If you’ve recently changed jobs or have a fluctuating income, it might raise red flags for lenders.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another critical factor that lenders consider. This ratio compares your total monthly debt payments to your gross monthly income. A high DTI ratio indicates that you may be over-leveraged, even if you have an 800 credit score. Lenders may be hesitant to approve your loan if they perceive you as financially burdened.

Multiple Loan Inquiries

If you have multiple inquiries or applications for new credit in a short period, it can negatively impact your chances of securing a loan. Lenders may view these inquiries as a sign of potential financial distress, leading them to question your ability to manage credit, regardless of your impressive credit score.

The Importance of Holistic Financial Health

In summary, while an 800 credit score is commendable, it doesn’t guarantee loan approval. Factors like income stability, debt-to-income ratio, and number of credit inquiries are integral to a lender’s decision-making process. Therefore, maintaining a holistic approach to your financial health is crucial for improving your likelihood of loan approval.

Discover more from Techtales

Subscribe to get the latest posts sent to your email.